Creating A Family: Talk About Infertility, Adoption & Foster Care

Adoption Tax Credit 2023

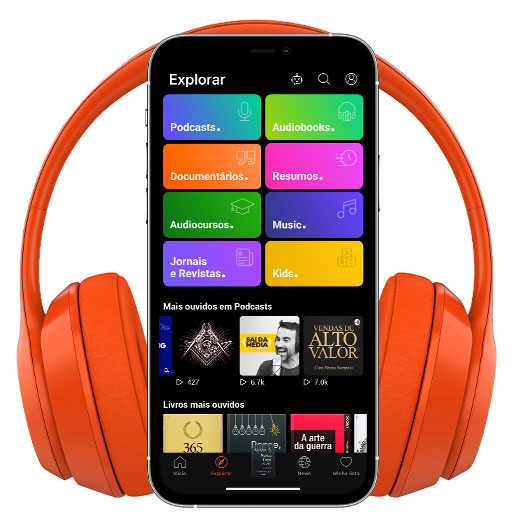

- Autor: Vários

- Narrador: Vários

- Editor: Podcast

- Duración: 0:54:08

- Mas informaciones

Informações:

Sinopsis

Could you qualify for the Adoption Tax Credit? Find out by listening to this podcast with Becky Wilmoth, an Enrolled Agent and Adoption Tax Credit Specialist with Bill’s Tax Service, and Josh Kroll, the Adoption Subsidy Resource Center coordinator at Families Rising (formerly the NACAC).In this episode, we cover:What is the Adoption Tax Credit for adoption being claimed on 2023 federal taxes?What is a “credit” and how does it differ from a deduction or some other form of tax savings?If you get a tax refund every year, how would you use the Adoption Tax Credit?If you don’t have any federal tax liability, should you still apply the credit to your federal income taxes?What type of adoptions are included or excluded? Stepparent adoption? Embryo adoption? Same-sex partner second parent adoption? Unmarried heterosexual second parent adoption? Surrogacy?Can you get credit for each adoption you complete even if completed in the same year? What about adopting siblings at the same time?What is a Qualified Adoption Expe