M&a Science

4. Why Decisive Communication is Vital for a Successful Integration

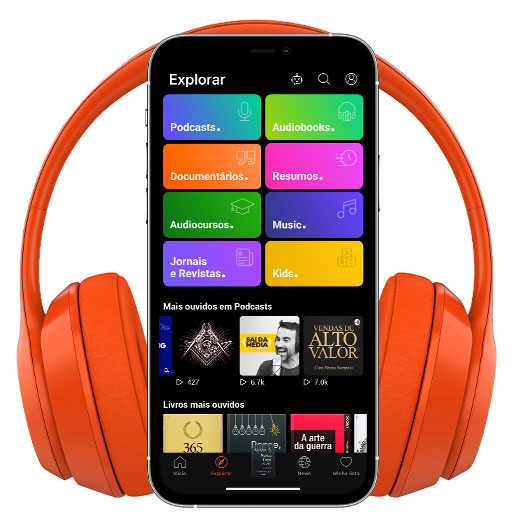

- Autor: Vários

- Narrador: Vários

- Editor: Podcast

- Duración: 0:56:27

- Mas informaciones

Informações:

Sinopsis

Jeremie originally started his career at Goldman Sachs and spent time in investment banking focused on equities, equity sales, and trading. He has experience on both sides of M&A, as an acquirer and “acquiree,” and says the deals he has seen in the past 10 years – some successful, others not – have changed his perspective on M&A. 0:00 – 2:12 Jeremie’s background in SaaS and investment banking 2:13 – 5:52 The value of focusing on giving in M&A transactions 5:53 – 11:40 Importance of pre-diligence diligence 11:41 - 14:12 Example of a deal not closed 14:13 – 15:50 Allocating resources and labor pool decisions 15:51 – 19:14 Advantages of quick integration 19:15 – 25:29 Painful lessons 25:30 – 30:57 How to use advisors 30:58 – 36: 11 How to pick a banker 36:12 – 41:33 Differences and clashes in culture 41:34 – 46:27 Setting up a deal framework 46:28 – 51:05 Facilitating good communication 51:06 – 52:22 Importance of prioritization 52:23 – 54:54 Lessons learned M&A Science by Kison Patel (kison@